2025 Gift Tax Exclusion Limit 2025. For the 2025 tax year, the annual gift tax exclusion is increased by $1,000 to a total of $19,000. In other words, giving more.

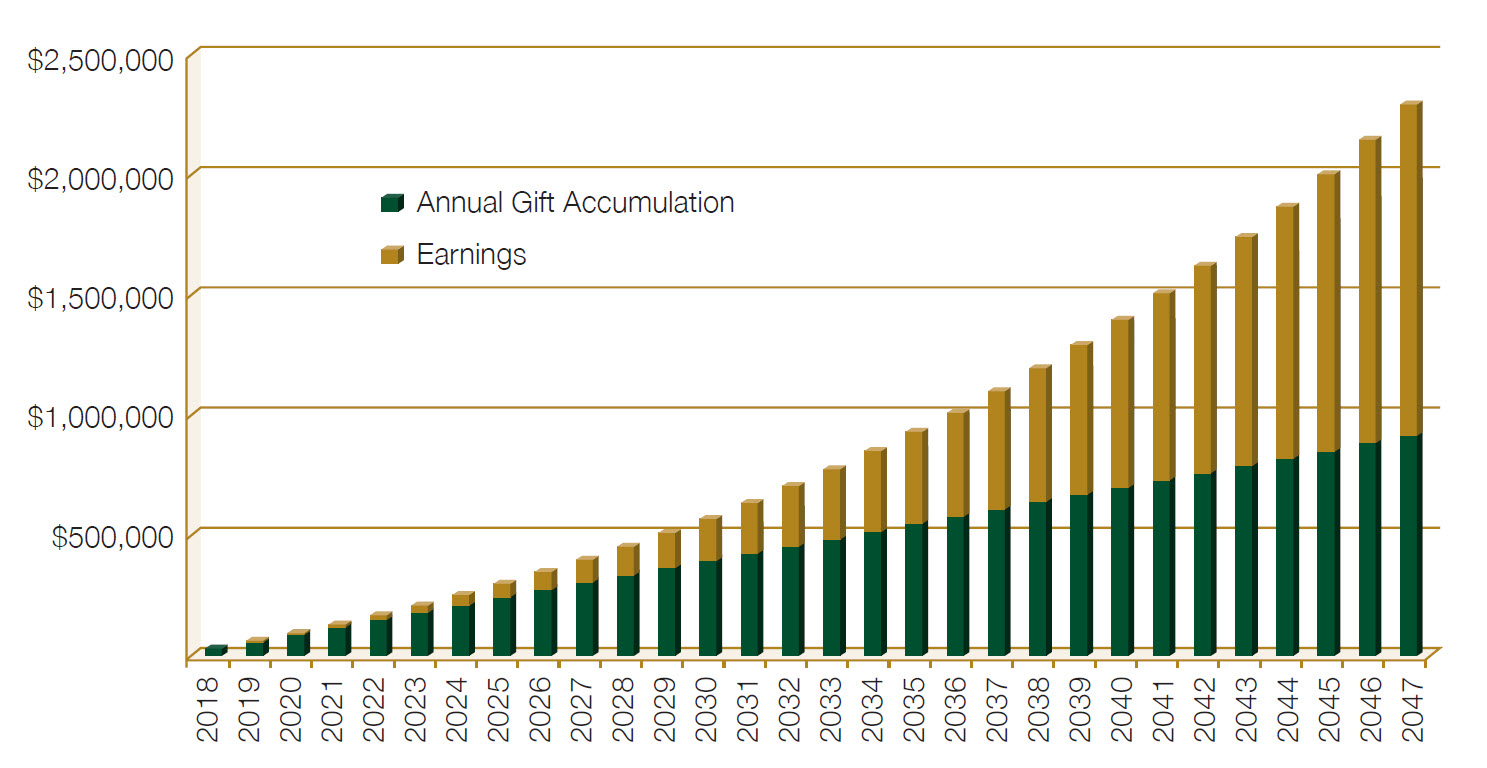

As you contemplate your estate. If you have assets in excess of the exclusion amounts, you should consider creating a plan to eliminate or reduce estate and gift taxes.

What Is The Gift Tax Limit For 2025 And 2025 Liza Sheryl, 2025 social security benefits 2.5% increase 2025 estate and gift taxes annual gift tax exclusions:

Lifetime Gift Tax Exclusion 2025 Irs Harry Hill, In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up.

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, The gift tax exclusion amount renews annually, so.

2025 Gift Tax Exclusion Maryl Sheeree, If you have assets in excess of the exclusion amounts, you should consider creating a plan to eliminate or reduce estate and gift taxes.

2025 Gift Tax Exclusion Limits For Married Couples Paige Johanna, Without any changes to the law, the estate and lifetime gift tax exemption will plummet to $5 million per person.

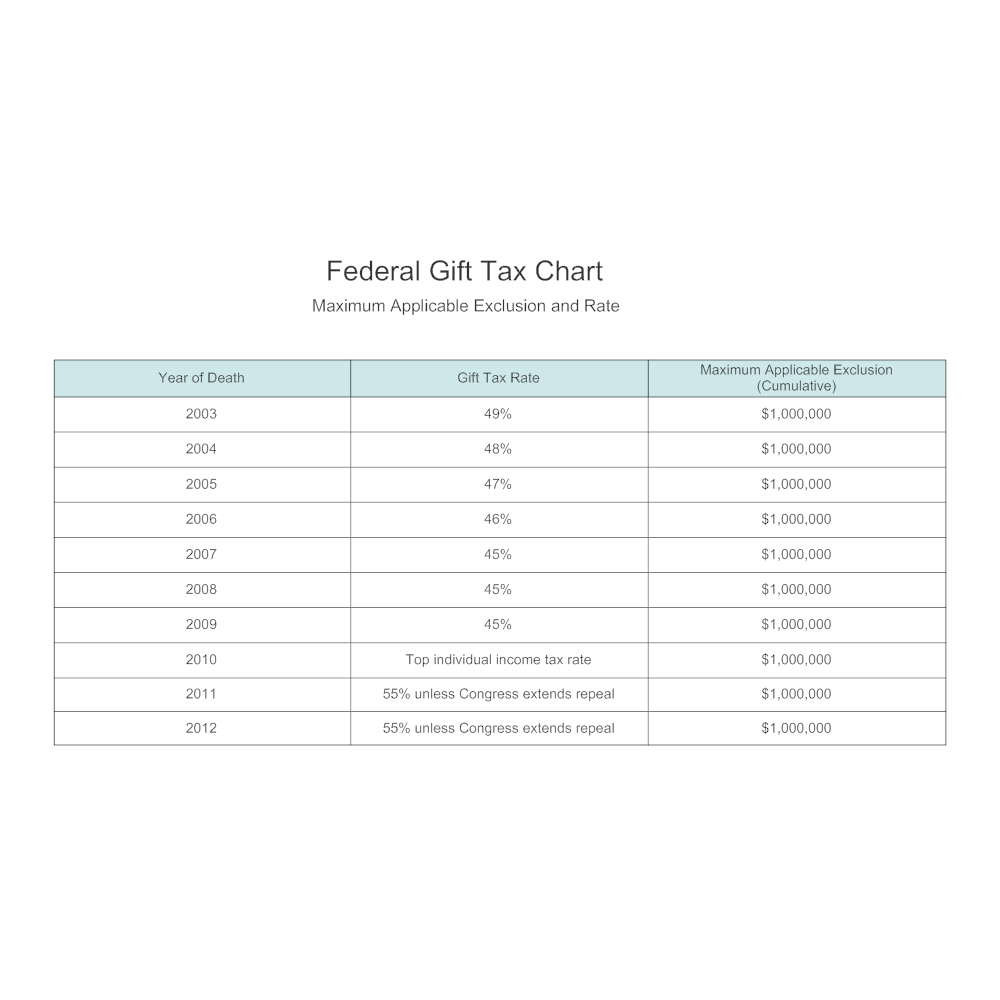

Gift Tax Rates 2025 Irs Ryan Greene, The act applies only to tax years up to 2025, and it requires the elevated exemption to sunset on december 31, 2025.

IRS Gift Limits 2025 A Comprehensive Guide Printable 2025 Monthly, There's no limit on the number of individual gifts that can be made, and couples can give double that amount if.